401k calculator with max contribution

The contribution limit for 2022 is 20500. A 401 k can be one of your best tools for creating a secure retirement.

401k Contribution Calculator Shop 56 Off Www Ingeniovirtual Com

Open A Traditional IRA Today.

. Individual 401 k Contribution Comparison. This calculator has been updated to. Plan For the Retirement You Want With Tips and Tools From AARP.

The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. Anyone age 50 or over is eligible for an additional catch-up. Reviews Trusted by Over 20000000.

In addition the amount of your compensation that can be taken. If you dont have data ready. Compare 2022s Best Gold IRAs from Top Providers.

You may find that your employer matches or makes part of your. We Go Further Today To Help You Retire Tomorrow. A Solo 401 k.

The IRS also limits the total contributions to 401k accounts. Employees can contribute up to 19500 to their 401 k plan for 2021 and 20500 for 2022. It provides you with two important advantages.

Solo 401k Contribution Calculator. This limit increases to 67500 for 2022 64500 for 2021 63500 for 2020 if you include catch-up contributions. 401k savings calculator helps you estimate your 401k savings at retirement based on your annual contribution and investment returns from now until retirement.

Employers usually set a limit on their match either as a certain dollar amount or as a percentage of the employees salary. HOW TO CALCULATE YOUR 401K CONTRIBUTION. Step 1 Determine the.

Your contribution amount cannot exceed your plan limit andor the 2020 IRS regulations 19500 You might have an additional opportunity if over 50. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Ad Learn About 2021 Traditional Contribution Limits.

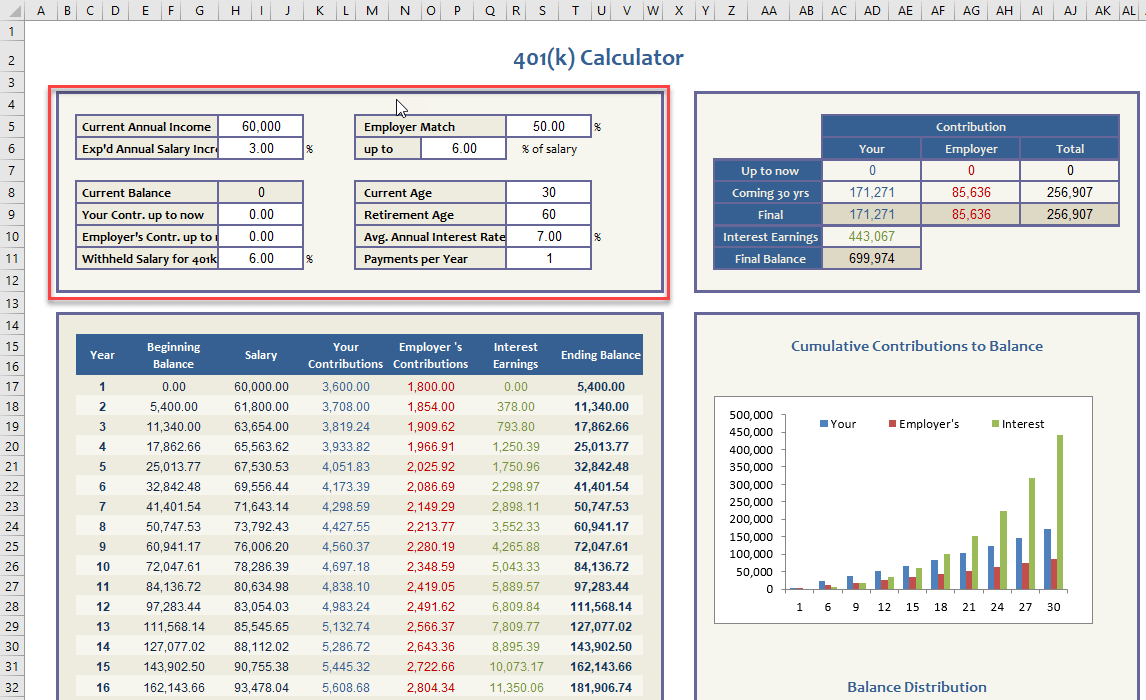

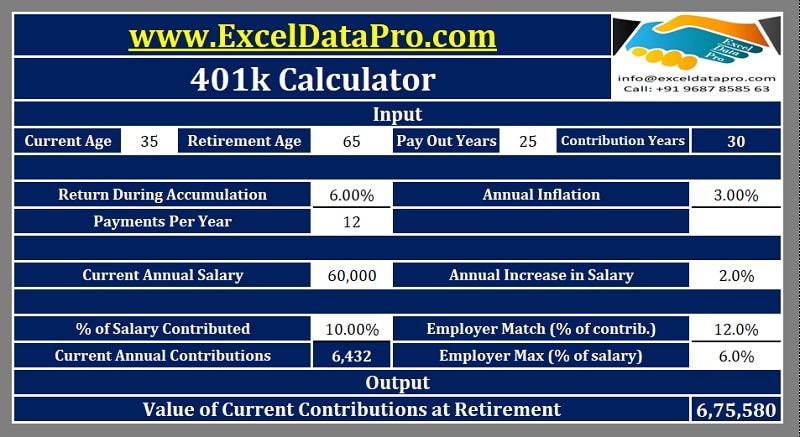

The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and. First all contributions and earnings to your. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings.

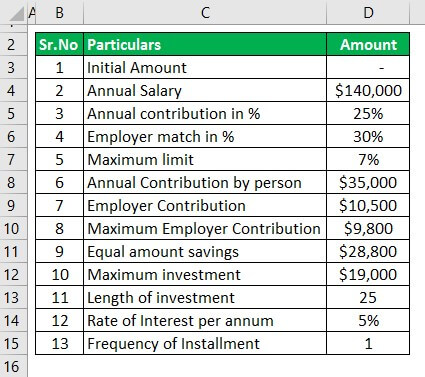

How to Calculate Using a 401k Contribution Calculator. One needs to follow the below steps to calculate the maturity amount for the 401k Contribution account. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit.

This federal 401k calculator helps you. 401k Calculator A 401k can be one of your best tools for creating a secure retirement. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation. After not being able to find any calculator or formula online for what I was looking for I decided to sit down and create my own. Your Contribution Your Annual Salary Percent to Contribute The maximum you can contribute to a 401 k is 20500 in 2022.

The limits for 2020 and 2021 set by the IRS are 19500 for a 401K plan. Ad Maximize Your Savings With These 401K Contribution Tips From AARP. Employees are allowed to contribute a maximum of 19500 to their 401 in 2020 or 26000 if youre over 50 years of age.

Use PaycheckCitys 401k calculator to see how 401k contributions impact your paycheck and how much your 401k could be worth at retirement. Ad Make a Thoughtful Decision For Your Retirement. You can use our 401 k calculator to see how much you.

Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. This calculator below tells you what percentage. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

The good news is employer contributions do not.

401k Contribution Calculator Shop 56 Off Www Ingeniovirtual Com

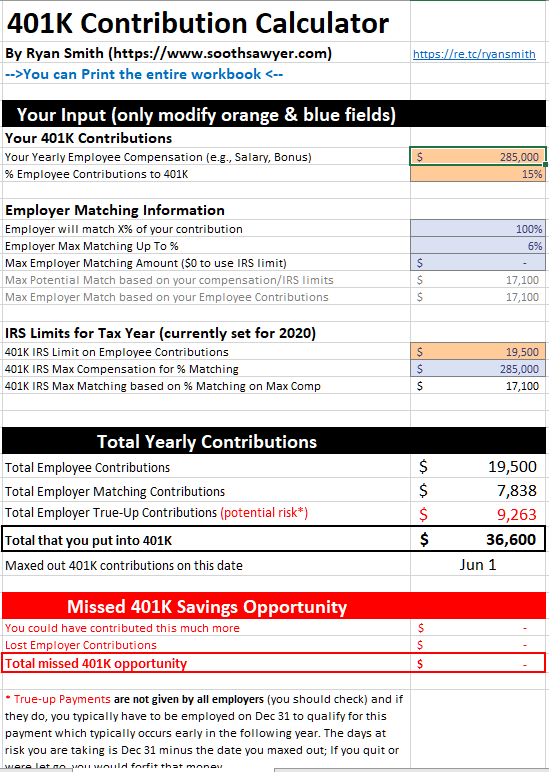

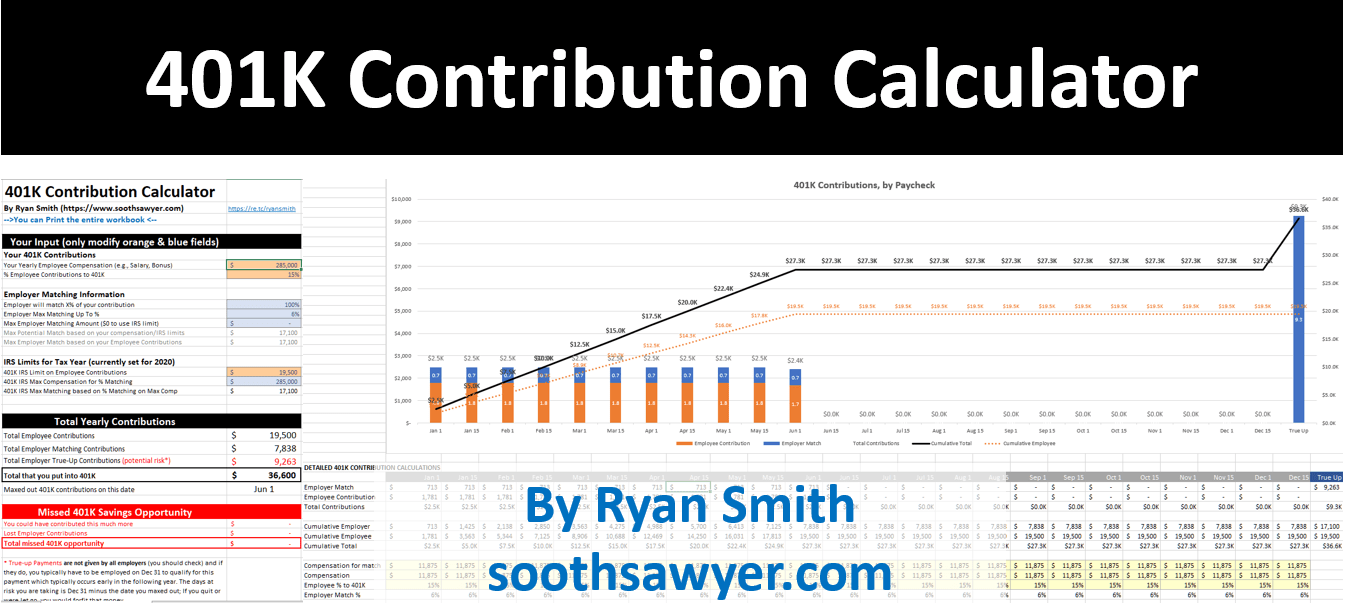

401k Employee Contribution Calculator Soothsawyer

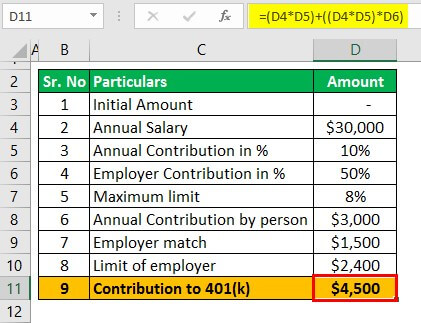

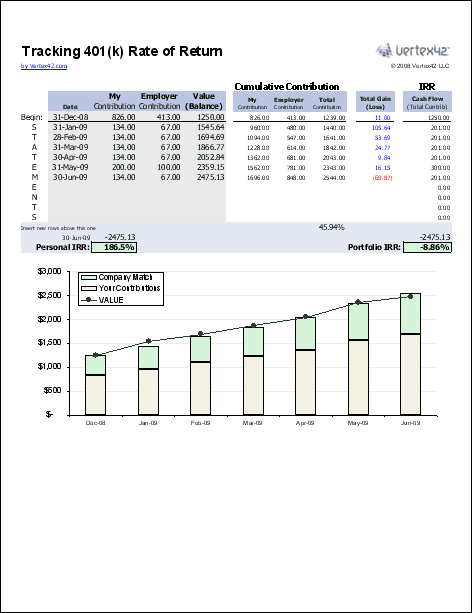

401k Contribution Calculator Step By Step Guide With Examples

Employer 401 K Maximum Contribution Limit 2021 38 500

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

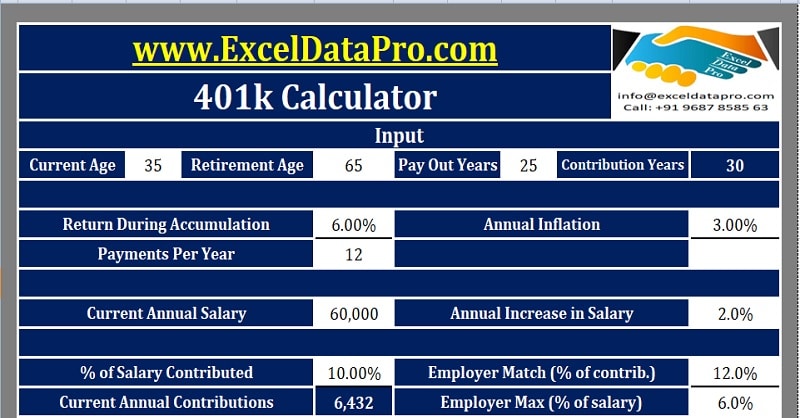

Download 401k Calculator Excel Template Exceldatapro

401k Contribution Calculator Shop 56 Off Www Ingeniovirtual Com

-savings-detailed.png)

401k Contribution Calculator Shop 56 Off Www Ingeniovirtual Com

Excel 401 K Value Estimation Youtube

Solo 401k Contribution Limits And Types

401k Contribution Calculator Step By Step Guide With Examples

The Maximum 401 K Contribution Limit For 2021

Solo 401k Contribution Limits And Types

Download 401k Calculator Excel Template Exceldatapro

401k Employee Contribution Calculator Soothsawyer

401k Contribution Calculator Shop 56 Off Www Ingeniovirtual Com

The Maximum 401k Contribution Limit Financial Samurai